Addressing The ABF Substrate Shortage With In-Line Monitoring

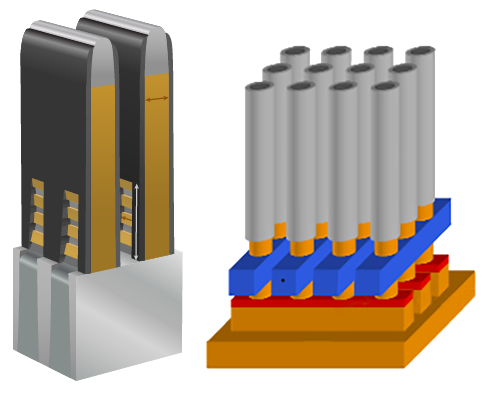

Ajinomoto build-up film (ABF) substrate has been a key component in chip manufacturing since its introduction shortly before the turn of the millennium. Substrates made with Ajinomoto build-up film – an electrical insulator designed for complex circuits – are found in PCs, routers, base stations, and servers.

Looking ahead, the ABF substrate market will continue to grow, with revenue up last year due to the strong demand for 5G, high-performance computing (HPC), servers and graphic processing units (GPU), as well as from the automotive industry. According to Goldman Sachs, the total demand for the ABF market should maintain a CAGR of 28% from 2022 to 2025. Like so many other essential components in the global supply chain, there is a shortage of ABF substrates.

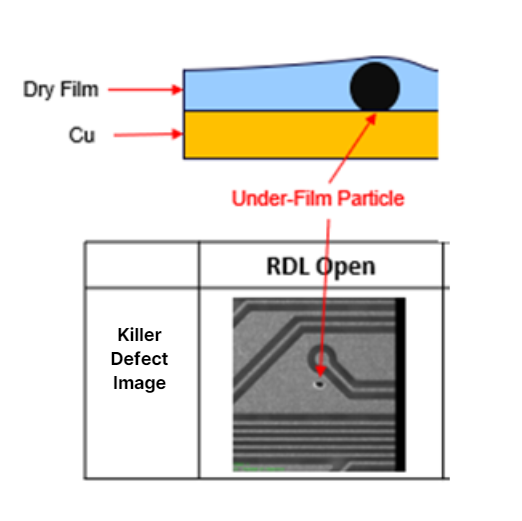

But rising demand and supply chain issues aren’t the only factors contributing to the shortage of ABF substrates. Larger package sizes and an increasing number of layers for these high-technology products also play a part; after all, these larger packaging sizes result in fewer packages per ABF substrate. And since the manufacturing of ABF substrate is a build-up layer process, a defect in any one layer can hamper the final yield of the entire substrate. Given these factors facing the ABF substrate market, yield control becomes even more important than it was before.